The Atrium Office Space For Lease, Chaka Road, Kilimani For Rent

Asset Value

KSH 155 sqft Monthly Rent

Net Yield

N/A

Spec 1

2 high speed elevators

Spec 2

24-hours security CCTV coverage

Spec 3

Professional property management

Lumen Square, Shivachi Road, Westlands.

Asset Value

Ksh 430,000,000

Net Yield

6%

Spec 1

59 parking bays

Spec 2

6 storey building

Spec 3

Office area of 2,572 sqm

Mlolongo Warehouse Godown For Sale along Mombasa Road

Asset Value

Ksh 80,000,000

Net Yield

N/A

Spec 1

Good for showroom and storage

Spec 2

Offices available

Spec 3

11500sqft

Trade Center Building in Nairobi CBD For Sale

Asset Value

Ksh 540,000,000

Net Yield

5%

Spec 1

17yrs remaining on the lease

Spec 2

Room for more tenants and income

Syokimau Industrial Asset – 6 Warehouses

Asset Value

KSh 400M

Net Yield

11%

Spec 1

57,000 sqft Warehousing

Spec 2

6 Go-downs

Spec 3

Strong Tenant Profile

ICD Industrial Complex Mombasa Road Logistics Hub

Asset Value

KSh 1.0B

Net Yield

14.8%

Spec 1

3 Acres

Spec 2

4-Storey Office

Spec 3

Showroom

Buffalo Mall and 9-acre adjacent development land, Naivasha

Asset Value

Ksh 680,000,009

Net Yield

11%

Spec 1

24hr Security

Spec 2

Car parks

Spec 3

Toilet

Wood Avenue Apartments Kilimani For Sale

Asset Value

KSh 1.0B

Net Yield

8.5%

Spec 1

80 Units

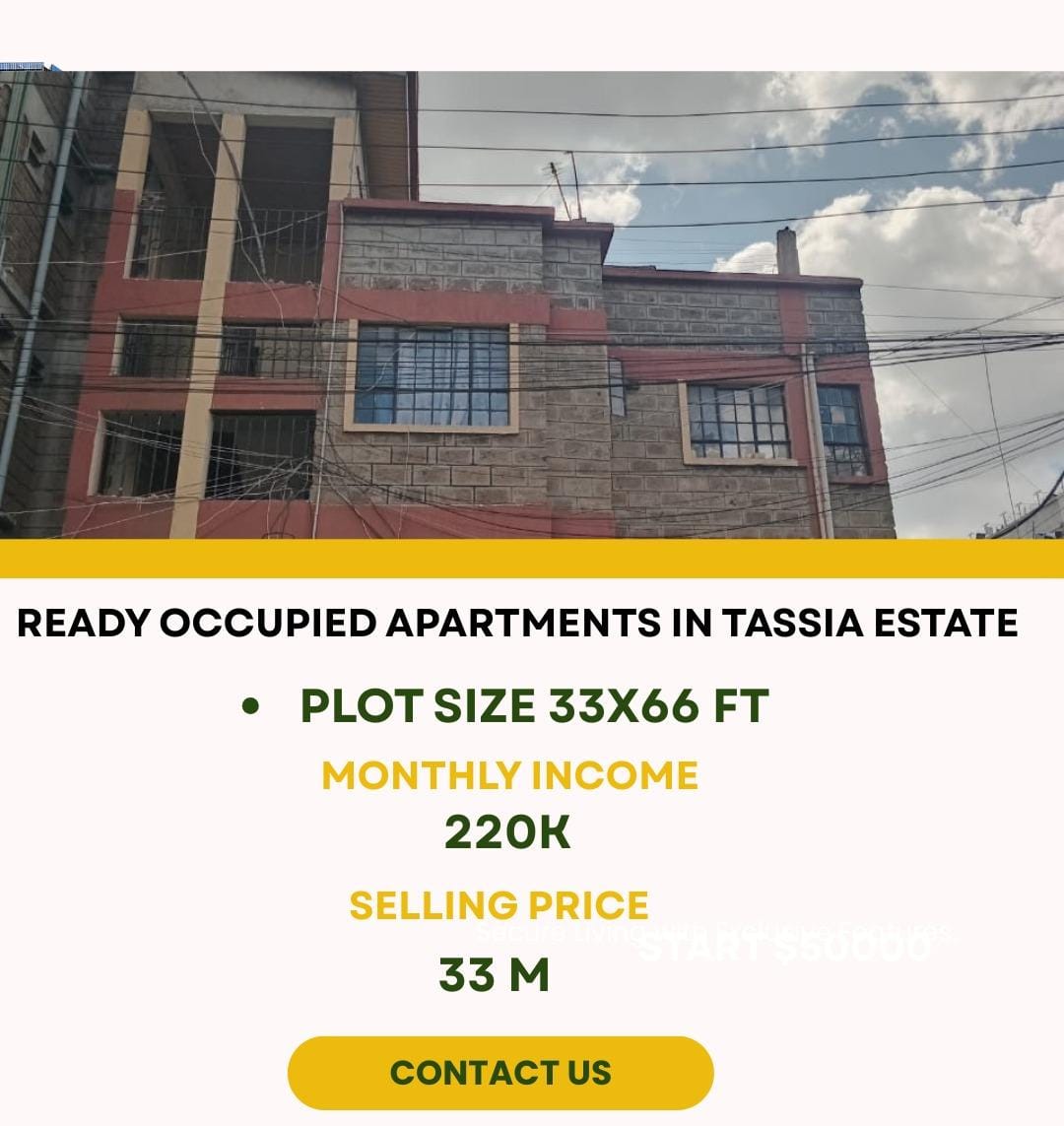

Tassia-4 II Prime Residential Block

Asset Value

KSh 33,000,000

Net Yield

8.06%

Spec 1

Ground floor + 4 floors

Spec 2

Secure and well-maintained

Spec 3

24/7 live CCTV monitoring

Tassia-3 Makuti Fully Occupied Apartment Block

Asset Value

KSh 23,000,000

Net Yield

11%

Spec 1

Strong yield (11.8% ROI)

Spec 2

Diverse unit mix

Spec 3

2 commercial shops

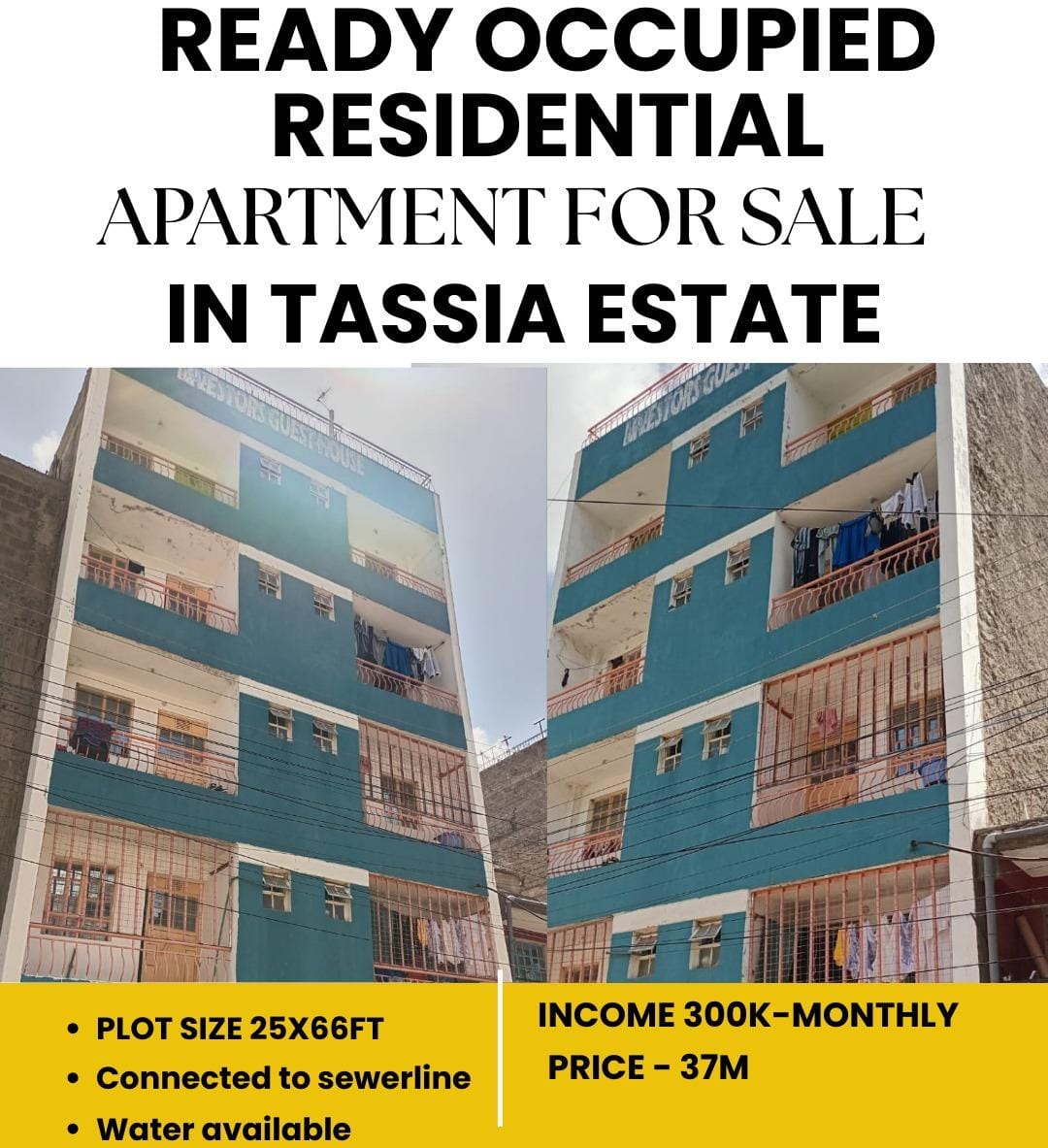

Tassia-2 High-Yield Residential Apartment Block

Asset Value

KSh 37,000,000

Net Yield

10%

Spec 1

High-yield investment (10% ROI)

Spec 2

Plot size: 25×66 ft

Spec 3

Multi-storey design

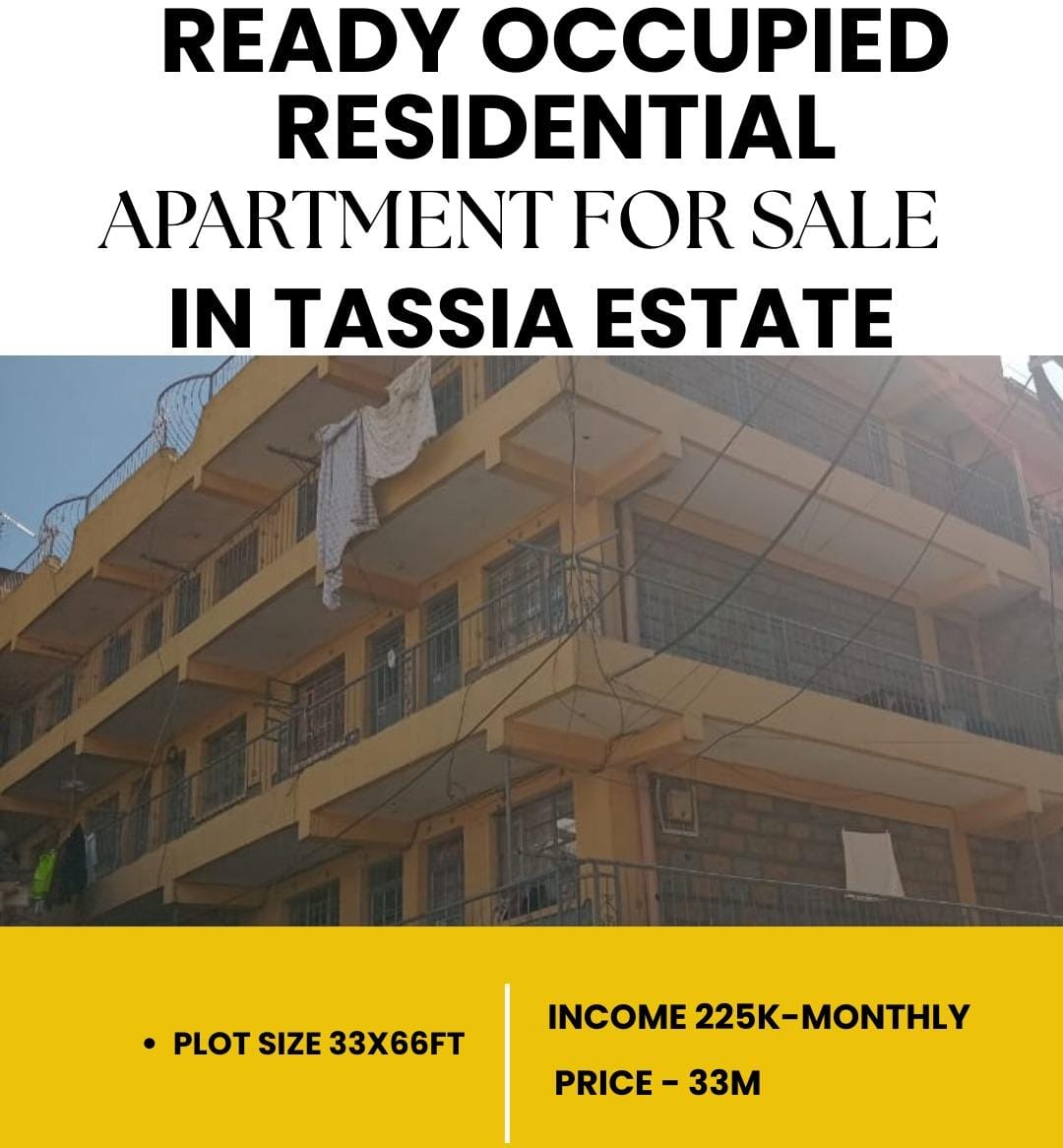

Tassia Fully Occupied Apartment Block along Outering Road

Asset Value

KSh 33,000,000

Net Yield

9%

Spec 1

Unfurnished units (tenant-customized)

Spec 2

Large plot: 2,178 sqm

Spec 3

Secure parking available

Absa Towers Building for Sale in Nairobi CBD

Asset Value

KSh 2.44B

Net Yield

9%

Spec 1

17 Storey Iconic Tower

Spec 2

143,300 sq.ft Net Lettable Area (NLA)

Spec 3

Grand executive reception area

Uchumi House Building For Sale in Nairobi CBD

Asset Value

KSh 570M

Net Yield

9%

Spec 1

6 Storey Building

Spec 2

143,300 sq.ft NLA

Spec 3

99.8% Occupancy

The Best Western Plus Meridian Hotel For Sale

Asset Value

$10,000,000

Net Yield

15%

Spec 1

119 Premium Suites

Spec 2

3.5 Star Rating

Spec 3

Executive Conference