What Is a Cap Rate? Calculating This Critical CRE Investment Metric

Key Takeaways

- A cap rate expresses an anticipated annual return on an investment property

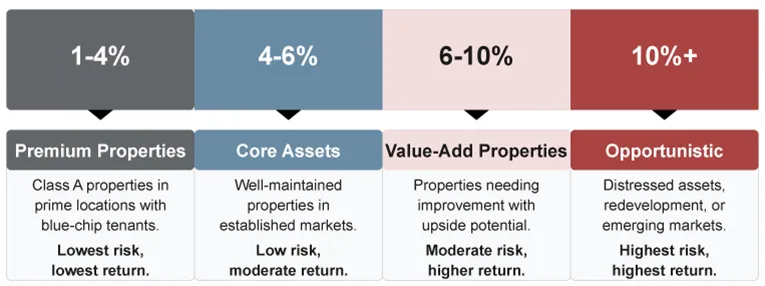

- Cap rates between 4% and 10% are considered standard in commercial real estate

- Lower cap rates indicate lower risk properties, typically in prime locations

- Higher cap rates suggest higher risk but potentially higher returns

What Is a Capitalization (Cap) Rate?

A cap rate, or capitalization rate, is a critical metric used in commercial real estate to evaluate the potential return on investment for an income-producing property. It is expressed as a percentage and represents the ratio between the property's net operating income (NOI) and its current market value or purchase price.

"A cap rate expresses an anticipated annual return on an investment property," explains Jonathan Squires, managing director at Cushman & Wakefield.

What Is a "Good" Cap Rate?

Defining what constitutes a "good" cap rate can significantly vary based on several factors, mainly: the investor's objectives, risk tolerance, the property's location, and the broader market conditions.

Typical Cap Rate Ranges by Property Type

How to Calculate Cap Rate

To calculate a cap rate, an investor needs to be in possession of at least two data points: the property's purchase price or market value, and the property's net operating income (NOI).

Cap Rate Formula

Cap Rate Calculation Example

If an investor was considering purchasing an industrial property for $2 million, and the property had an NOI of $100,000, you would divide $100,000 by $2 million, which results in .05, or a cap rate of 5%.

Factors Influencing Cap Rates

⬆️ Higher Cap Rates

- Rising interest rates

- Less desirable location

- Tenant instability

- Economic uncertainty

- Older building condition

- Market oversupply

⬇️ Lower Cap Rates

- Strong rental growth

- Prime location

- High-quality tenants

- Long-term leases

- Modern infrastructure

- Limited supply

Why Do Investors Use Cap Rates?

Cap rates became dominant in real estate as the sector was increasingly institutionalized. "As real estate has become more of an institutional investment, we've seen the cap rate become the first question that anyone has when looking at a property," notes Squires.

✅ Benefits of Using Cap Rates

- Simple to calculate and understand

- Enables easy comparison across properties and asset classes

- Helps assess perceived investment risk

- Provides quick initial screening of opportunities

- Industry-standard metric for communication

Ready to Start Investing in Commercial Real Estate?

Understanding cap rates is just the beginning. Explore our comprehensive guides on property evaluation, financing options, and investment strategies to build your commercial real estate portfolio.

Tags

LoopNet Team

Senior Market Analyst at Murivest Realty Group with over 10 years of experience in commercial real estate investment and market research. Sarah specializes in identifying emerging market trends and investment opportunities in Nairobi's commercial property sector.